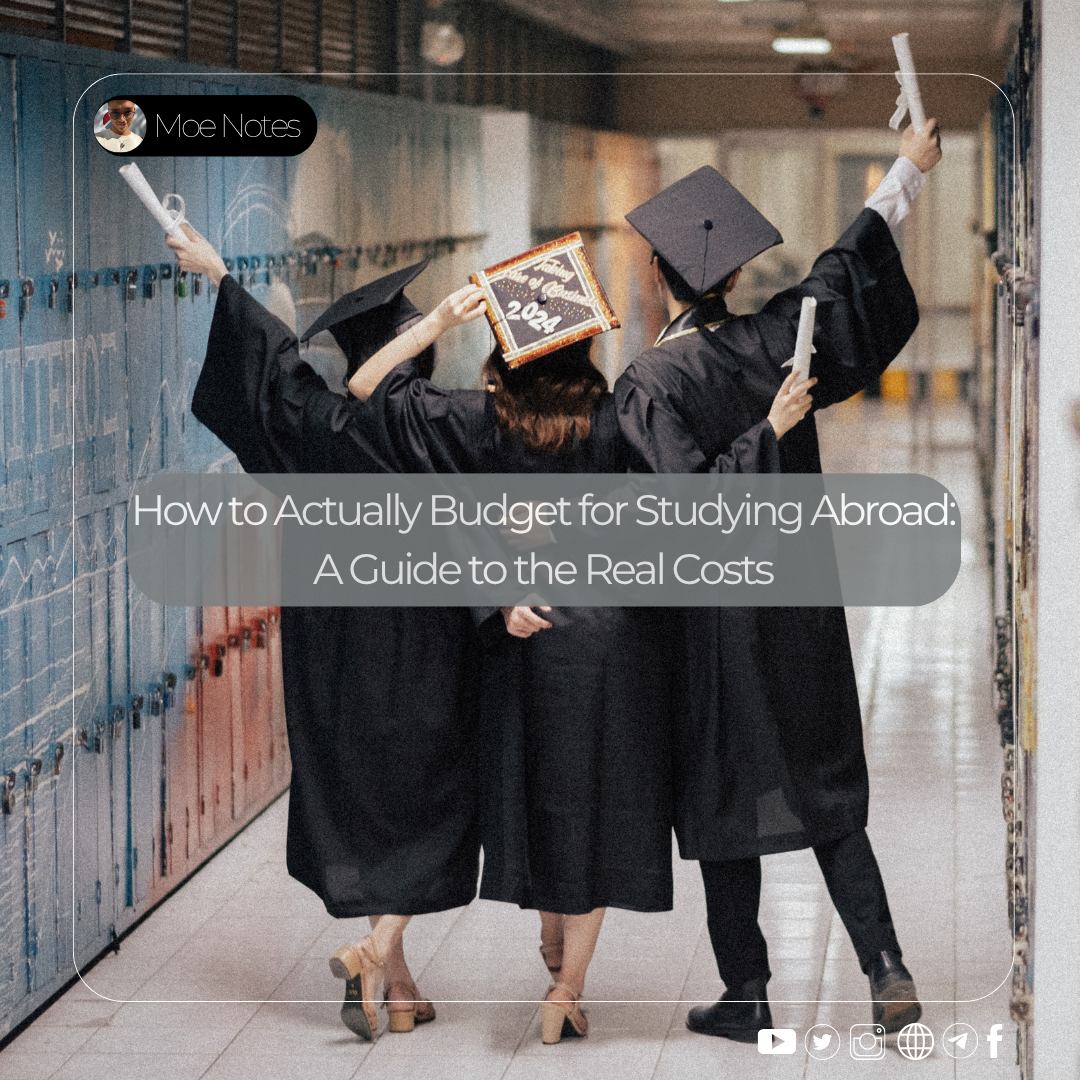

How to Actually Budget for Studying Abroad: A Guide to the Real Costs

This article is also available in [Burmese]

"A look at estimated vs. actual living costs, and the unexpected expenses no one tells you about."

I have touched on the costs of studying abroad in previous articles, but today, I want to dive deep into how you should actually calculate your budget. What factors must you consider from the very beginning? How do you estimate costs, and which of those estimates are likely to be accurate versus wildly wrong?

The Core Problem: Forgetting That Everything Has a Price

When you decide to go abroad, you have to understand that the small conveniences of home disappear. You can no longer buy 500 kyats worth of boiled peas from a street vendor. You can’t borrow a screwdriver from a neighbor for free. There’s no handyman who will show up on his trishaw to fix a broken pipe for a small fee. Abroad, every single one of these things has a significant, formal cost.

This is why studying abroad is so expensive. All the small, invisible costs of daily life that were absorbed by your family home suddenly become your direct responsibility. The most common mistake I see people make is creating a budget that is far too simple:

- Tuition Fees

- Accommodation Costs

- Food & General Expenses

This method is guaranteed to fail. Let's break down why and calculate the real costs.

Part 1: The Real Cost of Your Education (My Architecture Student Case Study)

Most people think the "cost of education" is just the tuition fee listed on the university website. This is the first mistake. Every major has its own additional, hidden costs for materials, equipment, and travel.

My tuition was initially estimated at £15,000, but the actual fee turned out to be £16,200, this year, around £18,000. On top of that, my major is Architecture—a field that is notoriously expensive. To succeed, you need tools. The most important tool is a high-specification laptop. The university might say it’s not mandatory, but in reality, it is. The absolute minimum for a laptop that can handle the required software is around £2,000 (100 lakh MMK). As a perfectionist, I knew I would need to spend even more.

Then there are the physical materials. This isn’t like high school where you just need a pen and a book. For my course, I spend hundreds of pounds a month on a huge variety of items:

- Specialized pens and pencils.

- Countless types of paper and sketchbooks.

- Materials for model-making (I recently spent £10 on bamboo weaving strips and £5 on UHU glue).

- Printing costs (£1 for a single A1 sheet).

- Travel costs for field trips (a round trip from Oxford to London starts at £30).

Finally, there are software costs. Many will say, "just use a cracked version." But what happens when a cracked file corrupts your final project a day before the deadline? Beyond that, it's an ethical issue. You can't use pirated apps for professional or commercial work. An official Adobe Creative Cloud license alone costs me £350 per year.

So, is the education cost still just £15,000? Not even close.

Part 2: The Real Cost of Your Home (Finding a Place to Live in Oxford)

Accommodation is one of the most variable and unpredictable costs. The "average rent" you see online is often a misleading fantasy.

When I was first looking, I budgeted for an average of £600-£700 per month. When I arrived, I discovered this was the absolute floor price for the least desirable rooms. As an architecture student needing to travel to campus frequently, I had specific needs: a direct bus route and, ideally, my own bathroom (an en-suite) to avoid queues when I needed to get to an early lecture.

The cheapest rooms had no private bathroom and a kitchen shared between 5 to 10 people. To get what I needed, my rent immediately jumped to over £800 per month (£190 per week) for a room that was acceptable, but not great. Even the most disgusting, cockroach-infested rooms are not significantly cheaper.

Furthermore, unexpected situations arise. For a short-term summer rental, I had to pay around £290 per week because of high demand and limited availability.

My annual accommodation cost, which I initially thought would be around £7,000, is actually closer to £10,000, and even higher this year because of the summer rental. This is a very common experience. Your personal needs will always push you above the theoretical "average."

Part 3: The Real Cost of Food (Why Your Body Type Dictates Your Budget)

This is the expense that people underestimate the most. No matter which country you go to, your food bill will be higher than you expect.

I initially budgeted £100 per week (£400 per month). I thought, "What could I possibly spend?" In the beginning, it seemed manageable. A croissant for breakfast (£1), a carton of milk (£1), maybe fish and chips for lunch (£10). But I quickly realized that I could not survive on Western food alone. The options for affordable ready-made meals are limited, and restaurant meals are a luxury, not a daily option. A single proper meal costs upwards of £8.

The only sustainable option is to cook for yourself. But here, another factor comes into play: your own body. I am over 6 feet tall, weigh 185 pounds, and have a high metabolic rate. I also lead an active, outdoor lifestyle. I need to consume around 4,000 calories a day to function—double the average person's 2,000 calories. This means my food bill is effectively for two people.

I can't survive on a small bowl of rice and some paste. That might save money, but as they say, "the stomach is the second brain." If you eat poorly, you think poorly. I am also someone who enjoys cooking a variety of cuisines, which means buying a wide range of herbs and spices. Furthermore, because I am on campus for long hours (often 9 AM to late evening), I can't carry three full meals with me. This means I inevitably have to buy snacks or a coffee on campus, which adds another £5-£10 to my daily costs.

After months of tracking, I found my realistic food budget:

- The absolute minimum I can survive on is £600 per month.

- My normal, comfortable spending is around £800 per month.

I am impressed by friends who manage on £400 a month, but for my body and needs, it's impossible. When you make your budget, be honest about your own body, your eating habits, and the food culture of your new city.

Part 4: The Real Cost of "Everything Else" (The Miscellaneous Budget That Isn't Miscellaneous)

This is the category that will destroy a poorly planned budget. Let’s look at the absolute minimums based on my experience:

- Tuition: £15,000

- Rent (cheapest): £7,000

- Food (most frugal): £3,000

That's £25,000 before you've bought a single bar of soap, a roll of toilet paper, or a plate to eat off.

"Miscellaneous" costs include:

- Initial Setup (~£500): When you arrive, your room is empty. You have to buy everything: a duvet (£20), a set of bedsheets (£20), a pot (£15), a plate (£2), a fork (£1), a glass (£2). This alone can cost hundreds of pounds.

- Toiletries & Cleaning (~£50-£100 per month): Shampoo, soap, skincare, laundry detergent. These are recurring costs.

- Unexpected Events:

- Moving House: As I detailed before, this cost me around £500.

- Essential Purchases: A good waterproof coat for the UK weather (£30-£150), a sturdy pair of shoes that won't fall apart after a month of walking (£50-£100), a durable umbrella (£20).

- Health: Emergency medicine for a cold or a minor injury.

- Social Life: A small gift for a friend's birthday.

These are not luxuries; they are the basic costs of a functional life. My miscellaneous spending is consistently in the hundreds of pounds every month.

Part 5: The Two Biggest Financial Risks You Must Plan For

1. Currency Fluctuation: The Unstable Kyat When I started my journey, the exchange rate was around £1 = 4,000 MMK. Just the other day, it was £1 = 4,900 MMK. This is nearly a 25% increase in cost. If your family has budgeted exactly 1000 lakh MMK per year for you, and the rate changes, you will suddenly be short. You must have a significant financial buffer to absorb these shocks.

2. Agency & Consultant Fees A formal fee for a good consultant might be around £500 for application and visa help. However, be wary of agencies that offer "free" services but are tied to their own private schools. Their "agency fee" is simply hidden inside the inflated tuition fees you will be paying.

Conclusion: A Final Word on Money to Parents and Students

Based on the June 2024 exchange rates (£1 = 5000 MMK), a year of study in the UK will cost an absolute minimum of 1300 lakh MMK (£25,000). A more realistic budget would be 1500-2000 lakh MMK (£30,000-£40,000).

To parents, please be understanding when your children say they are over budget. The costs are real and often unpredictable.

To students, please be responsible. This is an immense financial sacrifice from your family. Your goal is to study, not to waste this opportunity on drinking, partying, and neglecting your work. Distinguish between your purpose—are you here to study, or to work?—and dedicate yourself to it. We all have to strive together.